Many states have rules in place regarding how attorneys need to maintain lawyers’ trust accounts. These rules vary from state to state but the common underlying theme is that as a lawyer, it is your job to act as a fiduciary of client funds. Most states have adopted Rules of Professional Conduct to help guide you in the maintenance and record-keeping requirements related to client trust accounts. Please refer to your individual state rules. This article is not intended to cover all rules related to handling and maintaining trust accounts. But it is intended to show you how Clio handles your trust account transactions and help you abide by any state imposed rules.

The fundamental aspects of a lawyer’s duty, related to handling client funds, include:

- Identification: Deposit funds into an account specifically labeled as a trust account

- Segregation: Keep client funds on deposit separate from lawyer’s own funds

- Accounting: A lawyer must create and maintain appropriate records of funds belonging to clients

In addition to these fundamental duties, some states impose additional specific duties upon a lawyer handling client funds. Below are a few of these duties your state may impose.

- Duty to identify and label funds: deposit into a clearly identified trust account

- Duty to notify the client upon receipt and deposit of funds

- Duty to maintain a separate ledger sheet for each client who has funds on deposit in trust account

- Duty to produce a full accounting for client funds which includes: amount of funds received and deposited, the amount of funds lawyer has paid or distributed out of the client’s trust account and the amount of funds still held in trust

One of the advantages of using legal-specific software, such as Clio, is that the software is built to provide trust accounting functions that are easy to manage and maintain. Clio has a number of great features to help you meet the above duties and manage your client’s trust funds worry-free. Let’s review some of these features of Clio’s trust accounting.

√ Clio Bank Accounts: Duty to Identify and Label Funds

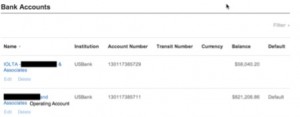

In Clio, you will setup, at a minimum, 2 bank accounts: one for your client trust funds and one for your general operating funds (revenue earned)

The trust account is a total of all client funds on deposit.

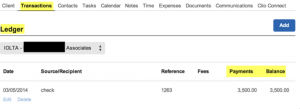

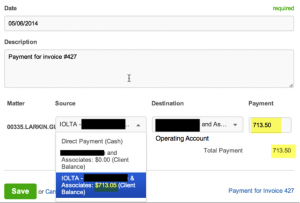

In Clio, you will record deposits into trust via the matter Transaction Tab and transfer money out of trust to your operating account when you apply funds entering a payment.

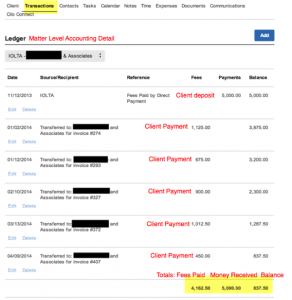

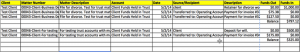

√ Individual Client/Matter Trust Accounts: Duty to Maintain a Separate Ledger and Notify Client

For each client who has funds on deposit in trust account, Clio keeps a running ledger of all deposits and withdraws (payments and/or refunds). Clio’s ledger report serves as a tool to notify the client upon receipt and deposit of funds. To fully account for funds, the lawyer must provide four pieces of information, all of which are included in Clio’s Client/Matter Ledger report:

- Amount of funds received and deposited

- List amounts of funds paid or distributed out of the trust account

- List any additional deposits to the client’s trust account

- Show balance of funds still help in trust account

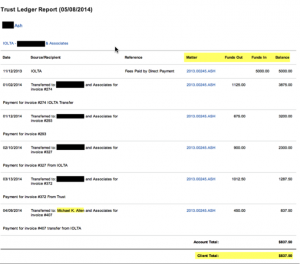

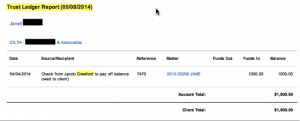

√ Individual Client Trust Ledger Reports: Duty to Provide Full Accounting of Funds

This Clio report shows all the trust account activity for a client and includes multiple client matters. This report can be used to fulfill your duty to notify clients of deposits and withdraws made from a client’s trust account. Clio creates an audit trail of all transactions related to the client funds in trust.

√ Client Trust Funds Maintained at the Client/Matter Level: Duty to Notify, Keep Accounting Records and Segregate funds at the Matter Level.

A feature you may not ever need but nice to know Clio can handle it is the ability to segregate client trust funds by matter. So if you have a client with multiple matters and each matter has a retainer on deposit, Clio takes care of this accounting for you. Clio has the ability to send all report data to an Excel spreadsheet. So if you want to format the data differently, you have this ability.

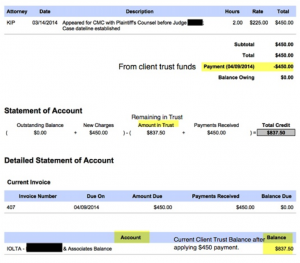

√ Invoices Include Accounting Record of Trust Funds: Duty to Notify Client

This is probably one of my favorite Clio features (since I am a little obsessed with following trust accounting rules). You can design your invoice template to include trust account transactions and show amount remaining in client’s trust account. In some states, you must provide this information at time of billing and applying funds. This is how Clio helps you notify clients and provide accounting detail to keep you in compliance with ethical trust accounting rules.

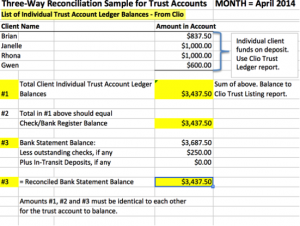

√ Extra Tips: Use Clio to Assist with your Monthly 3-way Trust Account reconciliation

As part of your duty to keep accounting records, you must reconcile your trust bank account on a regular basis. Some states impose the duty to conduct a 3-way reconciliation. What is a 3-way reconciliation?

- A 3-Way Reconciliation means that your Clio trust bank balance matches your checkbook (register) trust balance and they both match the Sum of all Individual Client Ledger Balances. Most accountants do not understand 3-way reconciliations. That’s no excuse for your lack of understanding. You have fiduciary responsibilities and you cannot delegate this responsibility. Below is a simple spreadsheet to use for a 3-way reconciliation.

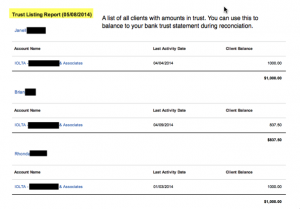

Using Clio to perform your 3-way reconciliation, Clio has all the reports and data you need to complete you 3-way reconciliation:

- Trust Listing report showing all individual client balances and total amount in your Clio trust account

- Trust Ledger report showing the detail of client funds on deposit

Use your trust bank account statement to complete the 3-way reconciliation.

So trust accounting with Clio is simple. It’s the Clio way. Please feel free to contact me for any help working with your trust accounts.

pgruenke@curolegal.com | 800-406-7336 | @PeggyGruenke | On LinkedIn

Share your thoughts